Total Assets Vs. Total Debt: A Research Survey

Dr.Goparaju Purna Sudhakar

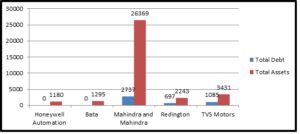

I did a survey of 33 (thirty three) BSE/NSE listed companies during January-March 2018. These companies come under mostly mid/large cap segment. The objective of the study is to find out the total debt of the company to compare with total assets and to find out whether total debt is less than annual revenues of the company. The findings were interesting. Also the objective is to find out is there any debt free company among BSE/NSE listed companies in India. (see Figure 1)

Figure 1: Total Debt Vs. Total Assets (as on March 2018 – in Rs Crore)

(Data Source: www.moneycontrol.com)

Research Findings include:

- Only Honeywell Automation India & Bata India Ltd. are the two companies with 0 (zero) total debt; Honeywell Automation has total assets worth Rs 1,180 crore and Bata has total assets worth Rs 1,295 crore as on March 2018.

- Cummins India has total debt less than 10% of its total assets; It has Rs 250 crore debt and total assets are worth around Rs 4000 crore.

- Majority of the companies have total debt more than 10% of their total assets/net worth.

- Industry having maximum debt is the banking sector.

- One more Interesting Fact is BSE Ltd., Bombay Stock Exchange, as a listed company has zero debt as on April 2018. It has around Rs 700 crore annual revenues.

Research Implication:

- These finding indicate whether company can clear off their debts using their one year annual revenue or in couple of years; or whether company goes further deep into debt.

- Total debt vs. Total assets can also be used as a parameter for long term equity investment decisions.

Happy Reading!!!

DrGPS