Greed and Fear drive the financial markets. These may even impact the sensible investors. Over a period of time industries and businesses linked to Indian economy will do well in equity market. Indian Equity Markets have returned 26% in CY2017. According to Outlook Money (January 2018) survey of top strategists and brokerages, top sectors which would build wealth for the coming year include Auto, Auto Ancillaries, Aviation, Hospitality, BFSI, Capital goods, Consumer Durables, and FMCG.

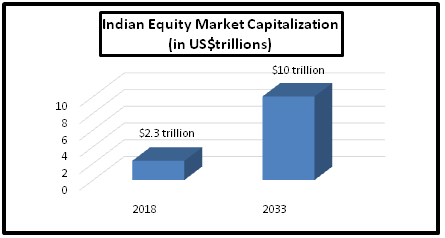

Indian Market Capitalization vs. GDP: Between 1992 and 2017 (in 25 years), Indian stock market capitalization has gone up by 5000 times. However, the investor base has increased by only 2% during the same period in India. In 2007, Indian market capitalization was 149% of Indian GDP (Source: BW Business World, January 06, 2018). As on January 2018, Indian market capitalization was around $2.3 trillion (Which is equal to 97% Indian GDP). By next 15 years, that is, by 2033, Indian market capitalization is expected to grow to $10 trillion. Huge opportunity here! (Source: Outlook Money, January 2018) (See Figure 1)

Some Important Facts about Indian Investors: As on 2018, equity investing in India is hardly 4% of total household investing; 57% of total investing is in real estate. According to Outlook Business (January 19, 2018), 46% Indian population is still unbanked.

Disciplined Investment Culture: Investing in quality stocks with long term vision by avoiding greed can build wealth for Indian investors. According to RakeshJhunjhunwala (2018), three important considerations for selection of stocks include:

i) Competitiveness of the company

ii) Opportunity before the company

iii) Valuation of the stock

One needs to classify the stocks into good business and good price. While also selecting stock, one should look at growth, valuation and liquidity of the stock. A typical investment cycle has 7 years in a stock market (to see results); exceptions may be there; for example US equity markets have seen meagre returns for a decade between 1990 and 2000.

“Don’t be dogmatic while purchasing/selecting stocks” – Rakesh Jhunjhunwala

How to Protect from Turbulent Market: Disciplined investing and diversified portfolio can protect you from turbulent stock markets/economies.